Account Login

- Home

- Mobiles

-

- News

-

All news

Latest news

Jan 12, 2026 /

Realme Neo8 Specs Leak: 165Hz AMOLED, Snapdragon 8 Gen 5

Jan 12, 2026 /

vivo Y500i Launched with 7200mAh Battery and 120Hz Display

Jan 12, 2026 /

Honor Magic8 RSR Porsche Edition Launch Date Revealed

Jan 12, 2026 /

Xiaomi 17 Max Leaks Reveal Massive 8000mAh Battery

Dec 25, 2025 /

Xiaomi 17 Ultra Launched with 1-Inch Camera & 6800mAh

Dec 25, 2025 /

Oppo Pad Air5 Launched with Dimensity 7300-Ultra

-

- Reviews

-

All reviews

Latest reviews

Jun 14, 2024 /

FreeYond M5A : A New Name in Budget Mobile

Apr 23, 2023 /

Xiaomi Pad 6 vs Xiaomi Pad 6 Pro Comparison

-

- Other

- Contact Us

Top 10 Smartphones

| Device | Total hits | ||

|---|---|---|---|

| 1 |

| 40910 | 2 |

| 32697 | 3 |

| 31275 | 4 |

| 26470 | 5 |

| 24674 | 6 |

| 24341 | 7 |

| 22764 | 8 |

| 22460 | 9 |

| 21394 | 10 |

| 21180 |

Best Ratings

Latest News

Latest Reviews

IDC: Huawei is no longer a Top 5 smartphone company in China - VIVO take place NO:01

Jul 28, 2021 Chathura Prabhaswara Gamage News 881 hits

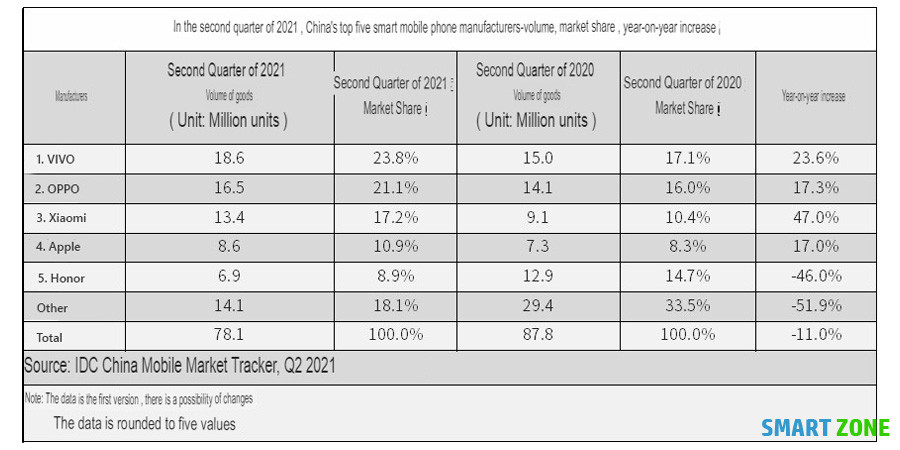

International Data Corporation (IDC) mobile phone quarterly tracking report shows that in the second quarter of 2021, China's smartphone market shipments were about 78.1 million units, a year-on-year decrease of 11.0%. In the first half of 2021, the overall domestic market shipments were 164 million units, a year-on-year increase of 6.5%. The driving force for market growth in the first half of the year came entirely from the better market environment in the first quarter compared to the same period last year. With the absence of the original blockbuster products in the second quarter, the existing products failed to fully stimulate the replacement demand of most users. , Leading to a decline in market attention, the terminal flow rate continued to be lower than expected after the end of the Spring Festival peak season, leading manufacturers had to slow down the pace of shipments in the second quarter.

From the perspective of the market structure, among the top five vendors, the top four vendors all have significant growth year-on-year, but they still cannot make up for the sharp decline of other vendors including Huawei in the overall market. On the one hand, it shows that products with gradual homogeneity of hardware and functions are accelerating the decline in attractiveness to consumers; on the other hand, it also shows that smartphones have long been a “just-needed” product with “one hand” and their brand pull and social The weight of decorative attributes is continuously increasing.

IDC China Research Manager Wang Xi believes that, objectively speaking, many models on the market this year have reduced their configuration and function innovation and upgrade, but many Android manufacturers have continued to accelerate their pace of entering the high-end market. Therefore, in the short term, competition in the domestic market, especially in the mid-to-high-end market, is a battle for products, but it is even more a battle for brand image.

The market performance of the top five smartphone manufacturers in the second quarter of 2021:

vivo with a rich variety of new Y Series product configuration to ensure that the richness of the layout of the mainstream price segment products, while sub-brand iQOO outstanding performance during the "618" also with the first quarter of X, S series form "relay in the high-end market ", stabilized vivo's market share at this price. Vivo ranked first in the domestic market with 18.6 million units shipped in the second quarter.

OPPO A32, A55, A93 and other inclusive products have become the main components of shipments this quarter. As the life cycle of the Reno 5 series with cumulative shipments exceeding 10 million is coming to an end, OPPO's market share in the price range of 350 to 450 US dollars (excluding tax basis, the same below) has fluctuated in the second quarter. But beginning in June, the iterative Reno 6 series products are designed with more recognizable colors, which is expected to help OPPO stabilize its market position at this price.

Xiaomi has maintained a relatively stable shipment volume against the backdrop of the overall decline in the market, and its market share has increased to 17.2%. Relying on the heavy investment in online channels during the "618" period and the continued good market performance of the K40 series, Xiaomi has effectively increased its market share in the 250-350 USD price range. In addition, as high-end products such as Xiaomi 11 Pro and 11 Ultra entered the market, the average unit price of Xiaomi products continued to increase. Xiaomi was also able to continue to expand cooperation with offline partners through more flexible channel policies to ensure the availability of offline channel stores. Rapid expansion.

Apple ranked fourth. Although the second quarter is Apple's traditional off-season, due to the changes in the domestic high-end market competition environment and the preferential activities of online core channels during the "618" period, Apple still achieved significant growth in shipments and market share in the second quarter.

Glory launch of Play 20, Play5 series, namely the online market and online market gain a good market performance, in which 20 Play series, in line to meet the basic entry-level market requirements of the customers, but also provides a good terminal Channel profits have brought new power to the market at this price range. In the Honor 50 series launched in June, among the same-positioned products in the offline market, the imaging functions are somewhat differentiated, and the pricing is also relatively competitive. After the above products helped Honor as an independent entity, it ranked first in the top five in the domestic market

SOURCE : IDC.COM

Leave a comment: